|

1. Summary

2. What’s interesting

Source:

0 Comments

Land seized in Clare after investigation into organised criminal gang - Agriland.ie 1. Summary

2. What’s interesting

Source:

https://www.agriland.ie/farming-news/land-seized-in-clare-after-investigation-into-organised-criminal-gang/ What happened?What happened? A man has been arrested after being identified as a suspected money mule herder following the search of a residence in West Tallaght, Dublin. Gardaí from the Garda National Economic Crime Bureau (GNECB) carried out a search at the property as part of a larger investigation into incidents of fraud in Norway, Germany, the US, Hawaii and Ireland. The investigation also looked into the subsequent laundering of money through money mule accounts, businesses, and trade-based money laundering operations. "Up to 50 different money mules have been identified as having laundered over €196,000 through his bank accounts in Ireland, Germany and Belgium," a Garda spokesperson said. "This money came from victims of mainly smishing frauds in Ireland, was initially laundered through these 50 money mule accounts and then forwarded by the money mules to the suspects' three bank accounts." During the course of the search, a number of items, including a "high value" Range Rover, which was suspected to have been purchased with the proceeds of crime, were seized. The following items were also seized:

What’s interesting?What’s interesting?

Source: https://www.irishexaminer.com/news/courtandcrime/arid-41205400.html Subscribe to our news service at HERE

Man charged over €6.5m cryptocurrency seizure in Dublin [August 8, 2024] 1. Summary

The judge also warned Mr Andrei that it would be a condition of his bail "not to carry out any cryptocurrency transactions" and make no comments on public forums, including social media, about the case. 2. What’s interesting

Sources:

Written by a www.MoneyLaundering.ie Guest Contributor Subscribe to our news service at HERE 1. Summary

2. What’s interesting

Source:

Written by a www.MoneyLaundering.ie Guest Contributor Subscribe to our news service at HERE 1. Summary

2. What’s interesting

Source https://www.breakingnews.ie/ireland/63-people-arrested-in-operation-with-gardai-and-interpol-1650689.html Written by a www.MoneyLaundering.ie Guest Contributor Subscribe to our news service at HERE

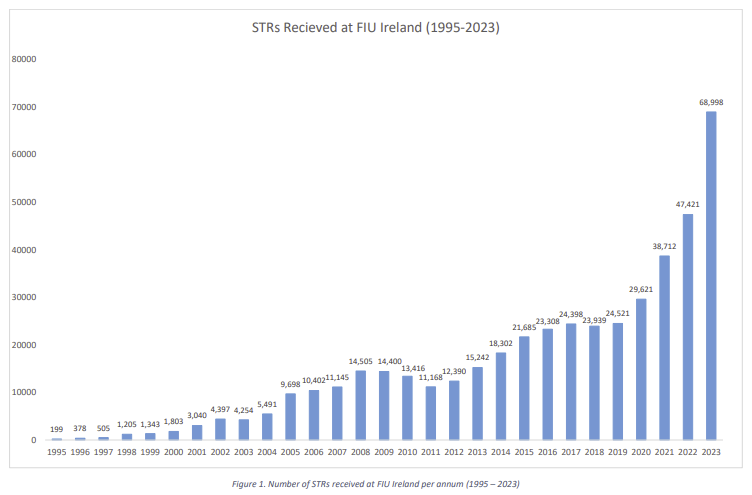

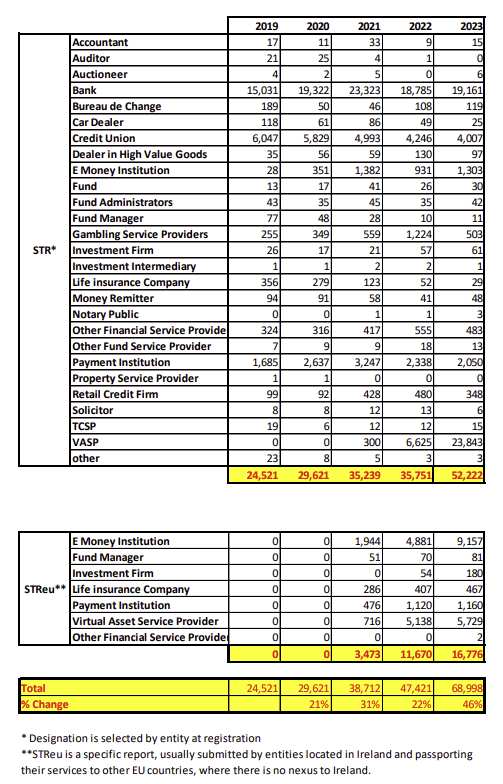

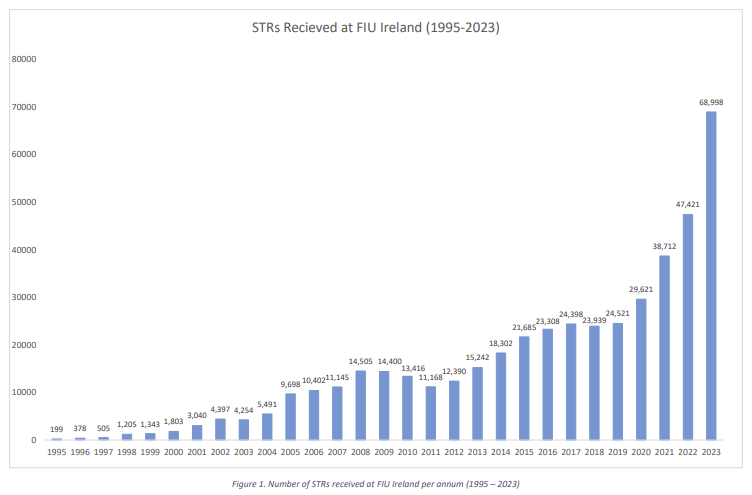

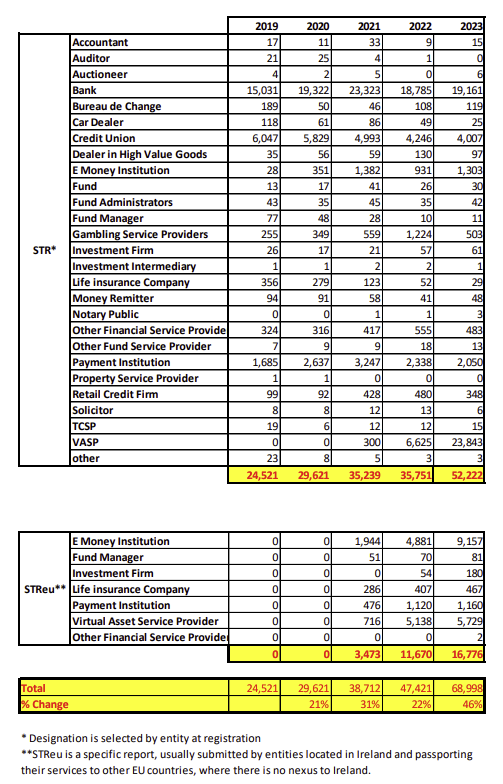

Download the Report here: https://fiu-ireland.ie/public_documents/strs_received.pdf Subscribe to our news service at HERE A Dublin man whose wife stole over €800,000 from Virgin Media where she worked in payroll has been jailed for money laundering.

John Murray (43), of Kilfenora Road in Kimmage, pleaded guilty to three sample counts, representing 10 charges of possessing the proceeds of crime, on dates between January 2009 and July 2019. He was sentenced to two years in prison after Dublin Circuit Criminal Court heard that his wife transferred a total of €872,470 to his Bank of Ireland account over the ten-year period. The court heard that Murray's wife, Kellie Walton (42), had been employed as payroll administrator for the company formerly known as TV3, apart from two periods when she took maternity leave. Over the decade, Walton transferred an average of €80,000 a year to her husband's account, most of which was spent on foreign holidays, premium TV channels and phone subscriptions. Passing sentence on Wednesday, Judge Martin Nolan said Murray should have known at a very early stage that his wife was stealing and that it was “very reckless” of him to have let it continue. He noted that the couple, who have four children, had squandered all the money. When counsel for the defence commented that there was a “tragic quality” to the fact that the couple had been left with nothing, Judge Nolan suggested that it was perhaps more “tragicomic”. Judge Nolan said Murray has no record of conviction, a very good work history and an impressive array of references on his behalf. He sentenced him to two years in prison. The court heard that Walton was sentenced in January 2023 to four years in prison, with the final two years suspended. She has already been released and is working part-time in a barbershop, the court heard. Garda David Jennings told Kieran Kelly BL, prosecuting, that Murray initially denied the charges and was due to start trial last month, but pleaded guilty on the day of his trial. Gda Jennings said Walton's salary as payroll administrator for Virgin Media was “in or around €30,000 a year”. “She copped a glitch in the system and was able to exploit it,” said Gda Jennings. The court heard that Virgin Media had three separate payroll systems for staff, casual workers and UK work. Gda Jennings said Walton invented details of someone who was owed money by the company and then regularly transferred money into her husband's Bank of Ireland account, making the payments look genuine. The offending came to light after an employee in Virgin Media's head office noticed unauthorised payments. The court heard that the majority of the money was spent on foreign holidays and subscriptions to channels including Sky Sports. Murray was arrested and acknowledged in a garda interview that the Bank of Ireland account was his. The court heard that €18,000 of the money was transferred to the bank account of a relative who was completely innocent and unaware that the money was the proceeds of crime. This money has been frozen and will be returned to Virgin Media, along with a further €12,473 remaining in John Murray's account. Virgin Media remains at a “substantial loss”, Judge Nolan said. Gda Jennings agreed with Dean Kelly SC, defending, that the money had been “squandered” as it was coming in, mostly on sales transactions. OverdrawnThe court heard that some months, Murray's bank account was overdrawn by a couple of hundred euro. Gda Jennings also agreed that the scheme was Walton's “brainchild” and that it was not executed or organised by Murray. Mr Kelly said Murray has been working consistently since he left school at the age of 15, including in car valeting, Rentokil and most recently at a hire company where he has worked for the last five years. The court heard that Murray's employer, who is aware of the charges, wrote a lengthy letter to court explaining that Murray is in a trusted financial position within the company, that he is a keyholder and handles cash. Two medical reports were also handed into court, showing that Murray has been diagnosed with cardiovascular disease for which he has been hospitalised. He is also on anti-depressants after suffering a depressive breakdown, the court heard. Letters were also submitted from Murray's son, sister and mother, urging clemency. Mr Kelly said Murray's culpability was “of a lesser order” than that of his wife, who had committed a serious breach of trust against her company. “He recognised an increase in his family fortunes, but he turned his face away about the mechanisms behind it,” said Mr Kelly, who claimed that there were no aggravating factors in the case against Murray. Mr Kelly said his client's family are now living in “reduced circumstances” in a rented apartment. Judge Nolan said Murray was unlikely to reoffend and was currently working and contributing to society, but he added: “Nobody can launder this amount of money and not go to prison.” Source: https://www.breakingnews.ie/ireland/dublin-man-whose-wife-stole-e800k-from-virgin-media-jailed-for-money-laundering-1614673.html Subscribe to our news service at HERE A bench warrant was issued for a man who is accused of assaulting two garda, handling stolen property and money laundering.

Andrei Plyshevsky, 48, with an address at 11A Eyre Street, Newbridge, Co Kildare failed to appear before a sitting of Portlaoise District Court. He is accused of handling stolen property, money laundering and having no insurance at M7 Morette, Portlaoise on February 13, 2024. He is further accused of trespassing on a building and assaulting two gardaí at the same M7 Morette, Portlaoise on the same date. Judge Andrew Cody noted the defendant had been stopped and allegedly found in possession of a large amount of stolen property. https://www.leinsterexpress.ie/news/crime---court/1468645/man-accused-of-assaulting-gardai-and-money-laundering-in-laois.html Subscribe to our news service at HERE Read more about thge TOTAL SARs RECEIVED UK

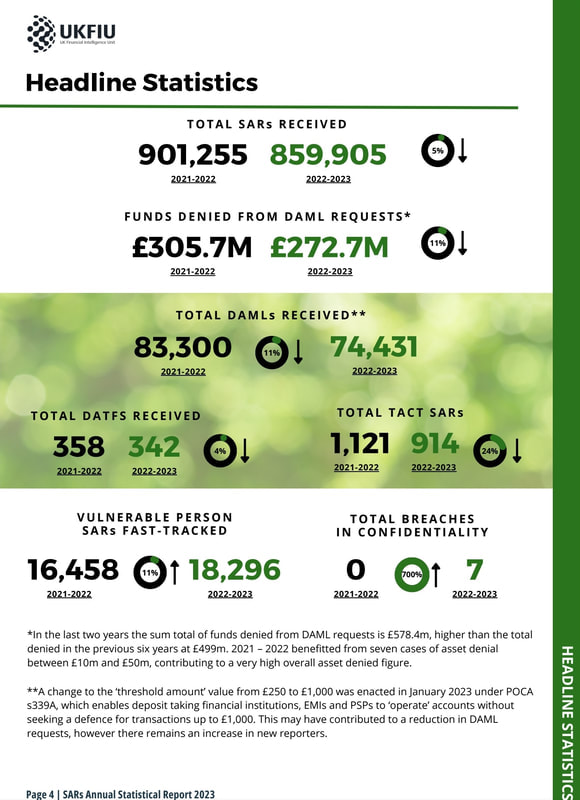

* 901,255 in 2021-2022 versus 859,905 in 2022-2023 FUNDS DENIED FROM DAML REQUESTS * £305.7M in 2021-2022 versus £272.7M 2022-2023 CLIICK IMAGE BELOW FOR FULL REPORT (otherwise here) Posted on moneylaundering.ie because of the fact that total trade in goods and services (exports plus imports) between the UK and Ireland was £89.6 billion in the four quarters to the end of Q3 2023, an increase of 10.4% or £8.4 billion in current prices from the four quarters to the end of Q3 2022. Where there is money, there is money laundering. A fact of life. Read more about the UK SARS regime here |

AuthorOn this page you will find a selection of links to articles useful for AFC training. Archives

September 2025

Categories

All

|

RSS Feed

RSS Feed