|

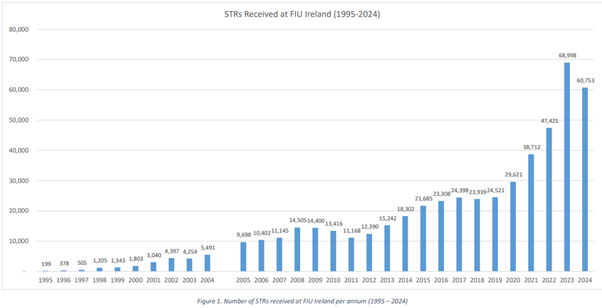

STRs Received at FIU Ireland (1995-2024)

1. Summary i. STR Volumes:

ii. Main Reporting Entities (2024):

iii. STReu (European Union reporting obligation):

2. What’s interesting i. VASPs volatility in STR reporting:

ii. E-Money Institutions as major STR drivers:

iii. Persistent dominance of banks but diversification of sources:

iv. International cooperation obligations:

0 Comments

More than €90,000 seized in money laundering investigation [September 14, 2025]

1. Summary: i. Over €90,000 in cash was seized in a money laundering investigation in Ireland, focused on large cash withdrawals from ATMs in Dublin and Cork. The Garda National Economic Crime Bureau (GNECB) led the operation, which followed transactions between 11 August and 9 September 2025. ii. The withdrawals used bank cards linked to accounts based in Poland and Norway. During the operation, a vehicle was searched in Lucan, Dublin on 13 September, where a substantial amount of cash and multiple bank cards were recovered. A male in his early-30s was arrested under relevant sections of Irish law. iii. Later, a woman in her 30s was also arrested at a Dublin address. Additional searches in Cork recovered more cash, foreign currency, false ID documents, bank cards and mobile phones. Gardaí are cooperating with international law enforcement through Europol in relation to the foreign bank accounts connected to this case. Both suspects remain in custody and the investigation continues. 2. What’s interesting i. Cross-border bank accounts & multi-jurisdictional risk

ii. Large cash withdrawals from ATMs as a red flag

iii. Use of multiple bank cards and false IDs

iv. Timing / detection window

v. Asset seizure & law enforcement cooperation

vi. Use of false/fraudulent documentation / identity fraud

vii. Potential reputational & regulatory risk

Source: https://www.breakingnews.ie/ireland/more-than-90000-euro-seized-in-money-laundering-investigation-1806873.html Student charged with money laundering after agreeing to act as money mule for text scam [September 12, 2025]

Summary: i. A 20-year-old student, Darragh Sutcliffe, pleaded guilty to money laundering after agreeing to act as a money mule for a “smishing” (text phishing) scam. He had no prior convictions. At the time of the offence, he was planning to sit accountancy exams. ii. Between 23-25 May 2023, €16,350 in fraudulently obtained funds from smishing scams were deposited into his account in four separate transactions. €9,350 came from one victim (Cork woman) via an “E-flow text scam” after she responded to a malicious message. Another €2,000 from a Killarney resident. iii. Sutcliffe withdrew about €3,500 from ATMs in Lucan before his bank froze his account. After his account was flagged, he went to Gardaí and made a false report to try to distance himself from the transactions. The banks reimbursed the victims, except AIB remained out €3,500 (the ATM withdrawals). iv. In court, his solicitor emphasised that he was a typical “non-complicit money mule” — i.e. someone who allows just their account to be used on promise of payments which never materialised. v. He’ll repay the stolen funds, was contrite, has family support; sentencing has been adjourned until February. The judge also ordered a €5,000 donation to a cancer charity. 2. What’s interesting: i. Money mule risk & identification

iii. Bank account usage, transaction monitoring, freezing mechanisms

iv. False reports / attempts to distance oneself

v. Financial harm & liability:

vi. Education & awareness as mitigation

vii. Sentencing & regulatory implications

Source: https://www.irishexaminer.com/news/arid-41704397.html Four charged in connection with international money laundering probe [September 8, 2025]

1. Summary i. Four people in central Dublin have been charged with money laundering involving proceeds of crime, in amounts ranging from around €29,000 upwards. ii. The investigation is being carried out by An Garda Síochána’s GNECB (Garda National Economic Crime Bureau) under organised crime legislation. iii. The alleged laundering involved use of bank accounts in Poland and Norway; there were large cash withdrawals from ATMs in Dublin and Cork over a period (11 August - 9 September 2025). iv. Items seized include cash, bank cards, false identification documents, and mobile phones.

ii. ATM cash withdrawal patterns as red flags: Repeated, large withdrawals via ATMs in different locations (Dublin & Cork), often a sign of layering or attempt to extract physical cash; good reminder to ensure outbound cash flow monitoring is strong (not just deposits). iii. False identities & multiple devices: Use of false IDs, multiple bank cards, mobile phones suggests efforts to obscure identity, complicate tracing. Reinforces the importance of strong identity verification (KYC), device monitoring if relevant, and forensic recordkeeping. iv. Regulatory / legal tools in play: Use of organised crime and criminal justice legislation (Sections under Irish law) shows that law enforcement is using serious legal powers. For compliance programs, this implies that suspicious activity reports (SARs) etc. must be airtight; any lapses could lead to legal/regulatory exposure.

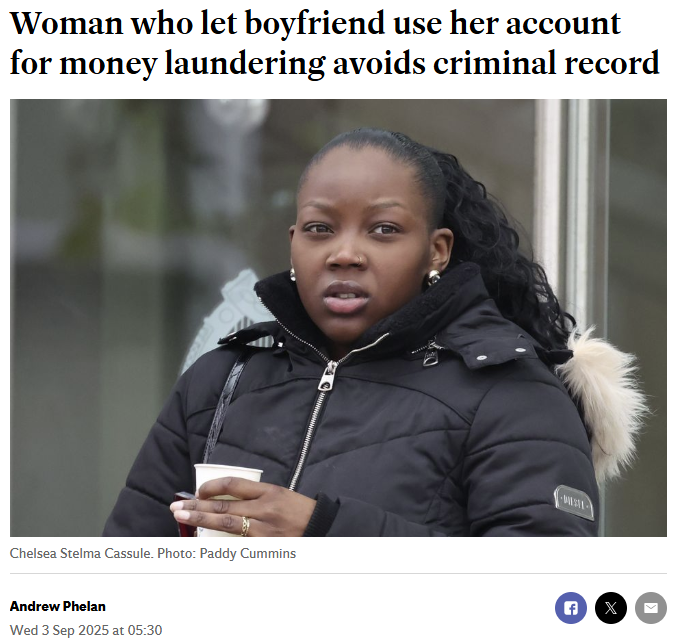

Very good AML typology on money mules and goes to show that highly educated people can be sucked-in to money laundering. I posted about it on Linkedin here and a guest contributor also wrote a detailed piece here. Noting this person's background of a business degree and work at an airline and tech company, quite possible that a career in financial services may be on the cards. That is certainly not over, but there will be a big hurdle to clear because the fact that no conviction was recorded doesn't mean that the person does not have to disclose it, It will raise concerns about judgement with a potential future regulated financial services provider employer. ➡️ A business graduate who let her “con-artist boyfriend” use her bank account to launder money has been spared a criminal record. ➡️ Chelsea Stelma Cassule (25) had been taken into her then partner’s trust when she gave him access to her account, which was used to transfer the €300 proceeds of a fraud. ➡️ Judge John Hughes struck the case out at Dublin District Court after hearing she had made a €300 charity donation and a probation report put her at a “low risk” of reoffending. ➡️ Cassule, of Brabazon Hall, Cork Street, Dublin 8, had pleaded guilty to money laundering – possession of the proceeds of criminal conduct. ➡️ Cassule had no previous convictions. ➡️ A defence barrister said the third party was Cassule’s boyfriend at the time. He told her he had a job opportunity in Belfast and was going to move there but needed a deposit and asked to use her account. ➡️ She did not know her boyfriend was defrauding anyone but in the cold light of day, she accepted the story was “a little bit fanciful”, the barrister said. ➡️ The accused had a business degree and had worked for an airline and a tech company. ➡️ Judge Hughes said Cassule had been “a victim of this herself” and had not made any financial gain. Her “con-artist boyfriend” had “taken her into his trust” and her suspicions were lowered, but she “should have known better”, the judge said. ➡️ The accused had an otherwise “unblemished” record. Source: https://www.independent.ie/irish-news/courts/woman-who-let-boyfriend-use-her-account-for-money-laundering-avoids-criminal-record/a1373019726.html

Woman who let boyfriend use her account for money laundering avoids criminal record [September 3, 2025]

1. Summary: i. A business graduate allowed her “con-artist boyfriend” to use her bank account for money laundering. ii. She was spared a criminal record in relation to that offence. iii. Her defence emphasised that she had been manipulated / misled by her partner, and that her involvement was passive (i.e. letting use of account rather than actively operating the laundering) and that she did not profit. iv. The court considered her personal circumstances (e.g. being misled, her lack of awareness of full criminality) when deciding to not impose a criminal record. 2. What’s interesting: i. Non-complicity / Naivety” defence

ii. Risk of insiders or account holders being exploited

iii. Court leniency & thresholds for criminal record

iv. Implications for account monitoring / KYC / due diligence

Inside an Irish Money Laundering Operation: A Case Study

When Gardaí raided a remote farm in County Clare, they didn’t just uncover livestock and machinery—they unearthed a sophisticated money laundering scheme that had quietly converted criminal proceeds into assets that looked, on the surface, perfectly legitimate. This case illustrates a classic Irish money laundering typology, showing how criminals place, layer, and integrate illicit cash within Ireland’s financial and property systems. Placement: Converting Cash into Tangible Assets The operation began with large volumes of cash generated from drug trafficking and organised crime. Instead of depositing the money directly into banks, where suspicious transaction reports (STRs) might be triggered, the criminals purchased agricultural land, machinery, and livestock. By acquiring a functioning farm, they could explain away large cash movements as agricultural income. This is a common Irish adaptation: cash-rich illicit groups investing in rural property or cash-intensive businesses (such as pubs, car washes, or construction firms) to disguise their income sources. Layering: Complex Transfers and False Trails Once the farm was operational, transactions became deliberately complex. Animals were bought and sold across county lines, often with inflated or understated valuations. Equipment was leased through third parties, and funds were moved across multiple Irish bank accounts in amounts just under the €10,000 reporting threshold. The criminals also relied on “money mules”—individuals, often vulnerable or indebted, who allowed their accounts to be used for funneling funds. This layering process created a tangled financial trail, frustrating investigators trying to trace the money back to its illicit origins. Integration: Dirty Money Becomes ‘Clean’ Over time, the scheme succeeded in integrating illicit funds into the mainstream economy. The farm produced legitimate revenue streams: cattle sales, EU agricultural subsidies, and lease agreements. Criminal proceeds were effectively rebranded as farm income. The perpetrators then used these seemingly legitimate profits to invest in vehicles, luxury goods, and even overseas property. By this stage, the money appeared clean—making it extremely difficult to prove its criminal origin without extensive investigation. This case demonstrates several AML red flags relevant to Ireland:

The case was eventually cracked by the Garda National Economic Crime Bureau (GNECB), working in partnership with the Criminal Assets Bureau (CAB). Assets—including the farm, machinery, and livestock—were seized under proceeds of crime legislation. Under the Criminal Justice (Money Laundering & Terrorist Financing) Act 2010, amended in line with EU directives, individuals convicted of laundering can face up to 14 years in prison and unlimited fines. In addition, the Central Bank of Ireland can levy significant administrative sanctions against financial institutions that fail to detect and report suspicious activity. This farm case typifies money laundering typologies in Ireland: criminal cash embedded in rural businesses, layered through complex transactions, and integrated into the economy via legitimate-looking revenue. For compliance officers, solicitors, accountants, and financial institutions, it serves as a reminder that criminal proceeds don’t always appear as stacks of cash in city banks—they may be hiding in plain sight on a quiet farm road in the Irish countryside. Source: https://www.irishmirror.ie/news/irish-news/crime/gallery/inside-clare-farm-criminal-assets-35794821 Two Guest Contributors wrote a piece on this story. See the other one here. Nail bar worker charged with money laundering after €80k seizure [August 26, 2025] Summary: i. Defendant: Quang Nguyen, 28, of Swords, Dublin; works in a nail bar. ii. Seizure: Gardaí recovered about €78,500 and £10,800 at his home. iii. Charge: Money laundering under section 7 of the Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 — accused of possessing those amounts as proceeds of crime. iv. Explanation given: Nguyen told Gardaí that the euros came from friends to help him open a nail bar in Drogheda; he could not explain the origin of the British currency. The people allegedly supplying the funds have not yet been contacted or verified by Gardaí. v. Background & other facts:

What’s interesting: i. Large cash holdings + unexplained source(s): The combination of a high cash amount and inability to clearly verify or document the origin of funds (especially from “friends”) is a classic red flag. Being able to trace and validate origins of large cash deposits is critical for AML compliance. ii. Cross-currency risk / multiple currencies: The presence of both euros and British pounds, with only partial justification for one, adds complexity. Monitoring for unexplained foreign currency inflows is important, especially in jurisdictions close to or dealing with different currencies. iii. Use of funds for business investment claims vs. money laundering allegations: Claiming the money was intended for investment (e.g. starting a nail bar) is a common defense. Compliance must ensure that business investment claims are backed by legitimate documentation (invoices, contracts, etc.) and corroborated sources, not just anecdotal “friend-gave-me-money.” iv. Presumption of innocence but burden of proof on source verification: The case highlights that while legal process presumes innocence, from an institutional/compliance standpoint you must act on strong indicators. Documenting KYC, performing enhanced due diligence where needed, and maintaining records so you can support or contest claims about fund origin are vital. Source: https://www.waterford-news.ie/nail-bar-worker-charged-with-money-laundering-after-80k-seizure_arid-68834.html

The saga of Thierry Fialek‑Birles—known in some circles as “Terry Birles,” the self‑styled Irish aristocrat—reveals the elaborate mechanics by which confidence fraud and money laundering intertwine, particularly in cross‑border contexts. His multi‑million‑euro scheme, which ensnared celebrated French comedian and filmmaker Dany Boon, was woven with layers of deception that offer vivid insight into typologies of transnational financial crime.

Claiming decency, heritage, and legal expertise, Fialek‑Birles convinced Boon he descended from an ancient Irish aristocratic family and was an Oxford‑educated maritime lawyer. Boon was drawn in by references to glitzy affiliations, including the Royal Cork Yacht Club, and grand plans involving yacht restorations and tax‑free investments with the (fake) Irish Central Bank These personal details were the foundation of trust—crafted authenticity intended to mask the reality of fraud and exploitation. Over several months, Boon transferred approximately €2.2 million for maintenance of his yacht and a further €4.5 million into a supposedly tax‑free investment scheme. Of course, that scheme was entirely fictitious. What emerges is a clear typology: criminals often deploy a mirage of legitimacy—be it elite education, exotic family history, or exclusive clubs—to lower suspicion and facilitate large financial transfers. Once the money was in, Fialek‑Birles dissolved the façade, vanishing from view. Subsequent investigations revealed he had exploited a network of shell companies across jurisdictions—Irish‑registered entities including South Seas Merchants Mariners Ltd Partnership (SSMM), as well as entities in Samoa, the British Virgin Islands, Antigua and Barbuda, and beyond. This corporate scaffolding served two purposes: obscuring the true ownership of funds and imprinting complexity into the trail—hallmarks of layering in money laundering typologies. Irish courts responded with stringent measures, including freezing orders (Mareva injunctions) that restrained assets—including yachts in Cork, property in Youghal, and offshore accounts—totalling upwards of €4.87 million in damages awarded to Boon by a High Court judgment. This demonstrates the integration of civil and criminal strategies to protect victims and recover assets. What does this typology teach us? First, exploitation of social engineering and reputation—as in claims of aristocracy or legal expertise—remains a potent tool in money laundering and fraud. Second, the use of front-companies and offshore jurisdictions is a recurring tactic to launder proceeds and obscure paper trails. Third, effective cross-border cooperation—from Interpol notices to freezing orders—is crucial for disruption. In essence, the fake aristocrat case underscores the risks when legitimacy becomes a façade. Criminals exploit cultural or institutional trust; legitimate structures—like courts and law enforcement—must respond with equal dexterity. Vigilance toward seemingly charismatic figures, investment opportunities, or inherited privilege remains a critical defense in the typology of transnational fraud and money laundering. Source: https://www.theguardian.com/world/2025/aug/26/dany-boon-french-film-star-the-fake-irish-aristocrat-thierry-fialek-birles-and-the-missing-euros Two Guest Contributors wrote a piece on this story. See the other one here. In late August 2025, a Dublin District Court case drew renewed attention to the use of cash-intensive businesses as potential vehicles for money laundering. Gardaí seized more than €78,000 and £10,800 from the home of a nail bar worker who claimed the funds were pooled from friends to open a new salon in Drogheda. While the accused insisted the cash was legitimate, the identities of these “friends” were never verified. Charged under section 7 of Ireland’s Criminal Justice (Money Laundering and Terrorist Financing) Act 2010, the case highlights the vulnerability of cash-based enterprises, such as nail bars, hairdressers, and takeaways, to exploitation by criminals seeking to disguise illicit proceeds.

Cash-intensive businesses (CIBs) are particularly attractive to launderers because their normal operations involve large volumes of physical currency, much of it untraceable. This environment creates opportunities to blend “dirty” money with legitimate earnings. A nail bar might take in hundreds of small cash payments daily, which makes it difficult for regulators or auditors to identify whether declared revenue figures accurately reflect real customer activity. By simply overstating takings, a business can introduce illicit cash into its books with little outward indication of wrongdoing. The laundering process often begins with placement: introducing the illegal funds into circulation. In the case of a CIB, this might mean recording criminal proceeds as part of the day’s takings. From there, layering can occur through deliberate manipulation of records or structured deposits designed to avoid triggering automatic reporting thresholds. In Ireland, banks are obliged to flag cash lodgements above €10,000, but launderers often “smurf” deposits, breaking down large sums into smaller amounts to slip under the radar. Once lodged, the money appears as legitimate business income, allowing it to be integrated into the financial system without immediate suspicion. This mechanism is not new, but it remains a persistent challenge for Irish authorities, particularly as criminal groups adapt quickly. The relatively low barriers to entry for businesses like nail bars or food outlets—combined with their dependence on cash—make them ideal for money launderers who seek plausible cover for unexplained wealth. Unless authorities can demonstrate a mismatch between declared turnover and actual activity, these businesses can provide a convincing front. Ireland’s anti-money laundering framework has attempted to respond to such risks. Under the 5th EU Anti-Money Laundering Directive, factors such as high reliance on cash or ownership by non-resident individuals are considered elevated risk indicators. Designated professionals, from accountants to property agents, are expected to carry out enhanced due diligence and file suspicious transaction reports where warranted. Yet the practical challenge remains: small-scale cash-based businesses operate at the margins of scrutiny, often falling below the thresholds that attract regulatory attention. The Dublin nail bar case underscores the importance of vigilance in this area. Cash-intensive businesses are part of everyday life and, in most instances, perfectly legitimate. However, their very nature provides the camouflage that money launderers need. For Ireland, strengthening oversight, improving the detection of red flags, and fostering a culture of questioning suspicious narratives will be essential if such businesses are to be prevented from becoming conduits for illicit finance. Source: https://www.breakingnews.ie/ireland/nail-bar-worker-charged-with-money-laundering-after-e80k-seizure-1795607.html |

AuthorOn this page you will find a selection of links to articles useful for AFC training. Archives

September 2025

Categories

All

|

RSS Feed

RSS Feed